Downsizers make half a million by moving from five-bed to a three-bed

- Rightmove says average downsizer could net £498,687 before costs

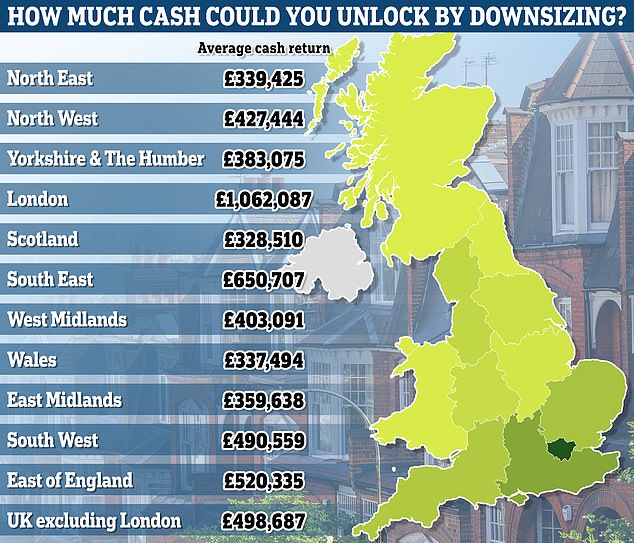

Homeowners could gain nearly £500,000 in cash on average by downsizing from a five-bedroom house to a three-bed, according to new data.

Those who own their homes outright in London could earn the highest return, gaining almost £1.1million in cash by downsizing from an average five-bed of £1.7million, to a three-bed averaging at £635,149, according to data from Rightmove.

However, the best returns in percentage terms can be found in the North East, where homeowners would be left with 65 per cent of their home's value in cash.

The UK average would see homeowners earn £498,687, though that figure doesn't take into account costs incurred in the moving process such as stamp duty.

Empty nest: Homeowners may be looking to downsize after their children move out. The regions in this list are ordered by the highest percentage return - see table below for details

The data is based on today's average property values and asking prices in each region, and assumes they move to a smaller home in a comparable area.

Rightmove property expert Tim Bannister said: 'Downsizing is a sensitive topic for many homeowners, as emotional ties and the inconvenience of moving often deter them from selling their family homes.

'However, empty nesters may overlook the significant benefits of downsizing, such as reduced energy bills and increased cash from purchasing a smaller home, that can still cover moving costs with leftover returns.'

The firm said homeowners can cash in as a result of a 36 per cent increase in property values since 2014.

Although less in cash value, those in the North East can earn the highest percentage return, recovering as much as 65 per cent of the value of their five-bedroom house, making a return of £339,425 from a five-bed house worth on average £520,873.

In the North West, homeowners would make back 64 per cent of their home's value, while those in Yorkshire and the Humber would make back 63 per cent.

Meanwhile those in in the East of England, the South West and the East Midlands would earn back just 58 per cent of the value of their home. Homeowners in Wales and the West Midlands could make back 59 per cent.

| Region | Average asking price 5-bed house | Average asking price 3-bed house | % difference in asking prices | Average cash return |

|---|---|---|---|---|

| North East | £520,873 | £181,448 | -65% | £339,425 |

| North West | £671,644 | £244,200 | -64% | £427,444 |

| Yorkshire and The Humber | £611,725 | £228,650 | -63% | £383,075 |

| London | £1,697,236 | £635,149 | -63% | £1,062,087 |

| UK excluding London | £805,804 | £307,117 | -62% | £498,687 |

| Scotland | £543,476 | £214,966 | -60% | £328,510 |

| South East | £1,089,597 | £438,890 | -60% | £650,707 |

| West Midlands | £679,449 | £276,358 | -59% | £403,091 |

| Wales | £574,934 | £237,440 | -59% | £337,494 |

| East Midlands | £617,709 | £258,071 | -58% | £359,638 |

| South West | £846,630 | £356,071 | -58% | £490,559 |

| Source: Rightmove | ||||

James Linder, regional sales director of Leaders Romans Group, said: 'We've observed a trend in downsizing among homeowners, particularly in towns with family homes and larger urban areas. Many people are downsizing to release equity, often using the substantial cash returns to help their children get onto the property ladder.

'We are also witnessing a demographic shift, with more individuals in their 60s opting to downsize, compared to the traditional age range of 70-80. This younger group is proactive in securing their financial future and reducing their monthly costs.'

On top of the potential cash savings made by selling up, people looking to downsize could also benefit from significant savings on energy bills and council tax bills by moving to a smaller property.

According to Rightmove, moving from a five-bed with an EPC rating of E, to a three-bed with a C rating, would save homeowners £3,806 per year on average.

'The potential savings on energy bills, council tax, and maintenance costs are considerable. Moving can save homeowners a significant amount annually in energy costs alone. Lower council tax and reduced upkeep expenses further enhance the appeal of downsizing,' Linder said.

Bannister added: 'By transitioning from a five-bedroom to a three-bedroom house, homeowners could still retain spare bedrooms for guests and free up on average half a million in cash for other uses before moving costs.'

What are the costs of downsizing?

Those who downsize won't typically pay capital gains tax, if both the home they are selling and the one they are moving to are used as their main home.

They will normally have to pay stamp duty on the purchase, however. Work out how much you would need to pay using our stamp duty calculator.

They will also need to pay all the usual costs of moving home, such as estate agent fees, conveyancing and removals.

The average cost of moving home is around £12,000, according to Halifax.