Markets Brief: Q2 Earnings Season Begins With the Banks

Plus: Large-cap stocks outperform again, and inflation data comes back into view.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Rate Cut Bets Increase

Economic data was sidelined last week as politics dominated the headlines. However, the latest jobs report on Friday was of interest to investors. Although the June numbers met expectations, downward revisions to the May and April data gave the impression of a slightly weaker economy, raising expectations of an earlier interest rate cut. This was reflected in data from CME FedWatch, which rated the probability of two or more 0.25% interest rate cuts by year-end at 77%, up from 63% a week ago. Tom Lauricella delves deeper into the job numbers and Morningstar chief US economist Preston Caldwell’s view of them.

US Large-Cap Stocks Outperform

Equity markets rose across the globe over the week. However, there was a sharp bifurcation between the largest technology companies and the rest. While the Morningstar US Large Cap Index rose 2.55%, the Morningstar US Small-Mid Cap Index fell 0.53%, increasing their valuation disparity. Technology stocks continued to drive returns among large companies, with Apple AAPL, Microsoft MSFT, Meta Platforms META, and Alphabet GOOGL especially strong. This reminds us how difficult it is to find good value investments in a market driven by strong sentiment. Morningstar’s behavioral insights team has advice to help investors distinguish between short-term sentiment and long-term risk tolerance.

Earnings Season Kicks Off

The company reporting season gets underway at the end of this week. Banks are among the first companies to report, and they are likely to set a disappointing tone, with profits expected to fall 10% compared with a year ago, according to FactSet Earnings Insight. Despite these downbeat expectations, the Morningstar US Banks Index has risen strongly this year. This apparent contradiction reflects the high concentration in the industry, with JPMorgan Chase JPM accounting for 34% of the index. While Morningstar’s analysts believe JPMorgan is a little overpriced, a deeper dive into the industry reveals plenty of opportunities. Morningstar banking analysts believe 50% of the companies they cover are undervalued.

All Eyes On the June CPI Report

Inflation will likely be back in the headlines this week, with the latest data on consumer prices due to be published on Thursday and producer prices (as a measure of input costs for companies) published on Friday. This data will be accompanied by several speeches by Federal Reserve Chair Jerome Powell and other central bank officials. Following the weaker job numbers, we can expect financial commentators to infer much from both the commentary and inflation data. However, it is important to remember that the link between short-term economic shifts and long-term returns is seldom strong. Investors should instead remain focused on the twin pillars of successful investing: quality and value.

Highlights of This Week’s Market and Investing Events

- Thursday, July 11: June Consumer Price Index report

- Friday, July 12: June Producer Price Index report, corporate earnings from JPMorgan JPM, Wells Fargo WFC, and Citigroup C

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended July 5

- The Morningstar US Market Index rose 1.73%.

- The best-performing sectors were technology, up 3.23%, and communication services, up 3.08%.

- The worst-performing sector was energy, down 1.19%.

- Yields on 10-year US Treasury notes fell to 4.28% from 4.36%.

- West Texas Intermediate crude prices rose 0.3% to $83.08 per barrel.

- Of the 702 US-listed companies covered by Morningstar, 273, or 38%, were up, three were unchanged, and 426, or 62%, were down.

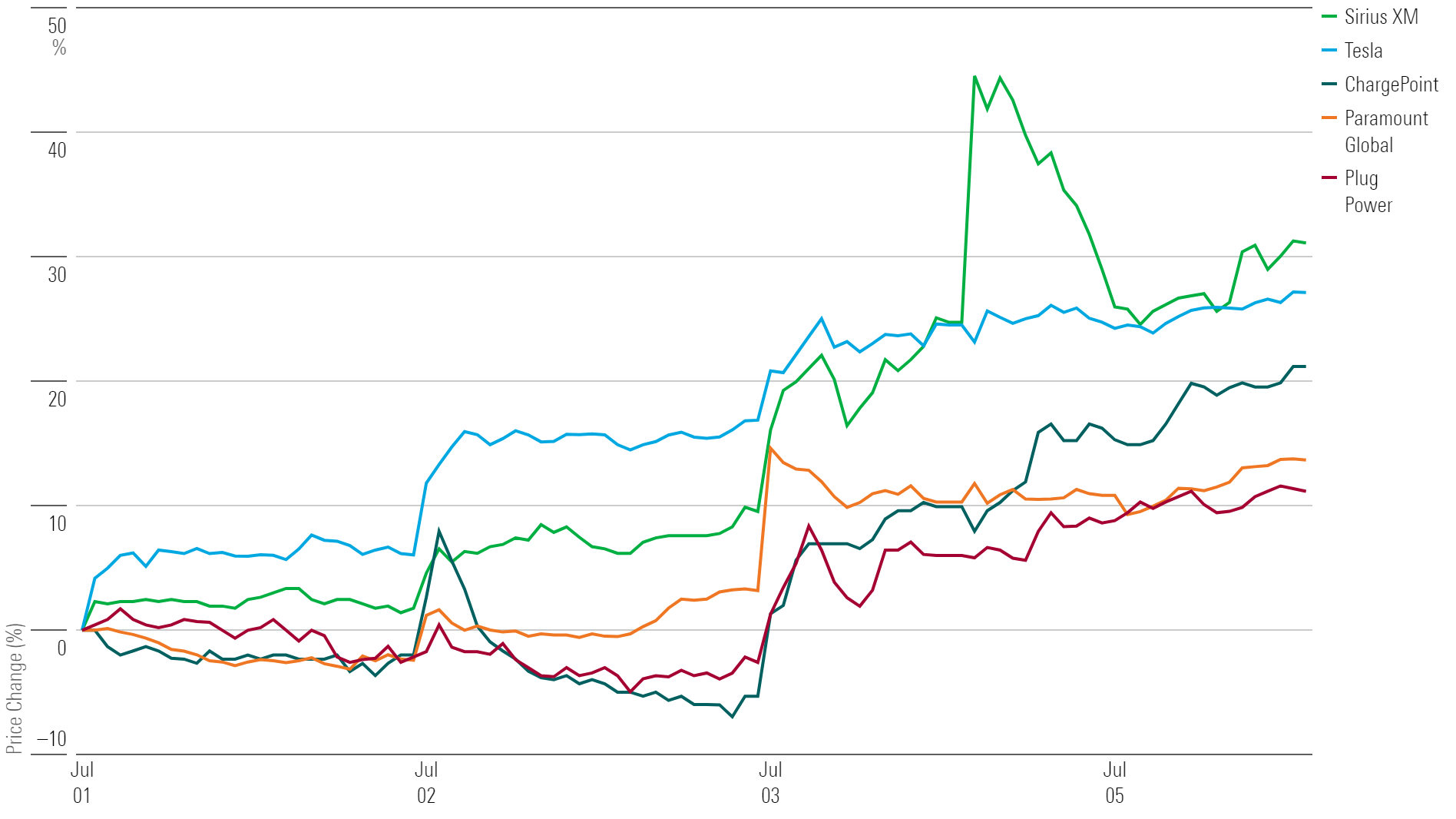

What Stocks Are Up?

Sirius XM Holdings SIRI, Tesla TSLA, ChargePoint CHPT, Paramount Global PARA, and Plug Power PLUG.

Best-Performing Stocks of the Week

What Stocks Are Down?

SunPower SPWR, Hawaiian Electric HE, New Fortress Energy NFE, Chewy CHWY, and Carnival CCL.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QXF236VFXBDQ5KN6KP575GOMAA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MCOHMFJ2MVEVPAJNB73ASRA4EA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TUMESES6KBGRBCCTKOV26XSHNA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)