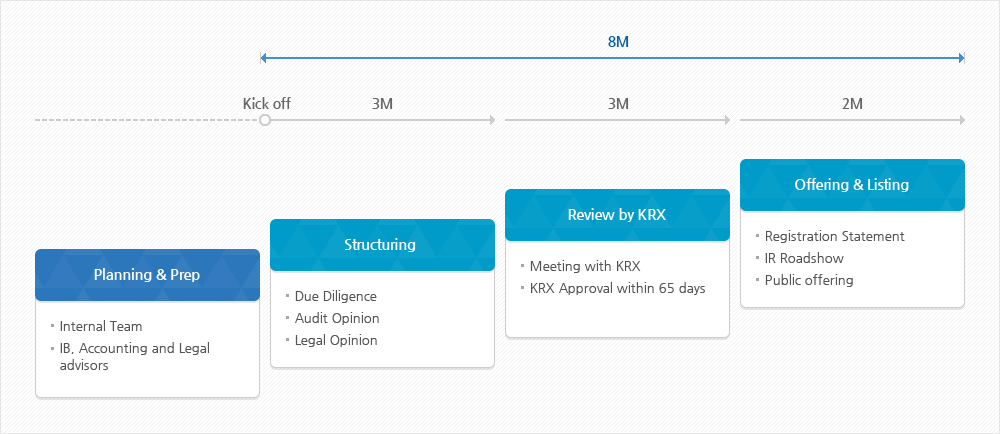

KRX offers predictable, fast and efficient listing eligibility review process for the sake of foreign issuers' timely fund raising through IPO on Korean capital market. The timeline for listing eligibility review is stipulated in KRX Listing Rule saying that the outcome of that review should be notified to the issuers within 65 business days from the date of application.

The foreign companies already listed on overseas markets designated by KRX* would be able to receive the outcome of listing review within 45 business days from the date of application. For those foreign companies listed on designated markets for more than five years, KRX Listing Review Committee review would be exempted and only the desk top review for the listing application documents would be applied, which means faster listing review than 45 business days.

주의NYSE-Euronext, NASDAQ, Tokyo Stock Exchange, London Stock Exchange, Deutsche Bourse, Hong Kong Exchange, Singapore Exchange, Australian Securities Exchange, Toronto Stock Exchange

- Fast Track Requirements

-

- Trading History : At least five year of listing on designated market(s)

- Mkt. Cap. : 2 tril. KRW (recent year) at the time of application for listing on KRX

- Revenue : 2 tril. KRW (recent year) & 1 tril. KRW (recent 3 year average)

- Profit : 300 bil. KRW (recent year) & 700 bil. KRW (recent 3 year sum)

- No disciplinary measures during the recent 3 years by the home country

exchange or regulator & by the overseas exchange or regulator in which the company is listed

The Lead manager and other professional advisors like audit/legal firms hired by the applicant can arrange for consultation meetings with KRX for better understanding of the company’s business and for identifying any potential issues before formal submission of the listing applications. This will speed up the listing process and reduce any additional costs that may arise due to delays in resolving those issues.