- Margin Concept

- A certain period of time is required in securities markets to settle a transaction after it has been executed. If the price changes in the meantime and a loss increases, there is a risk that payment obligations may not be fulfilled. Therefore, exchanges require trading parties to deposit a predetermined amount of collateral to guarantee settlement. This collateral deposit is known as a “margin.”

In addition, since derivatives (futures and options) transactions are high-risk/high-return products that entail a considerable risk of loss, collateral is always required in order to guarantee settlement. Accordingly, exchanges cover the risk exposure of the counterparty by systematically monitoring a number of variables, including market fluctuations, and collecting a margin commensurate with the position (risk exposure) of each party. - Kinds of Margin

-

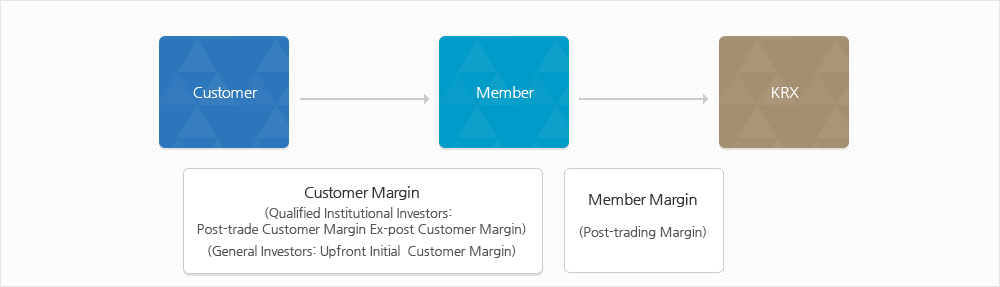

[Margins for Exchange-traded Derivatives]

Margin is classified by the payer and payment time. The customer margin is paid by customers to members and the member margin is paid by members to the KRX. Initial margin is paid in advance of the order placement while Post-trading margin is paid after the market is closed.

- Composition of Margin

-

- Margins for the Securuties Market

- Margins for the securities market consist of: ① a variation margin that amounts to the valuation profit and loss when closing a position at the present time; and ② a net risk margin calculated according to the estimation of losses that may arise from future changes in price.

- Margins for the Exchange-traded Derivatives Market

- Initial customer margin comprises i) order margin for a new order, ii) net risk margin on holding open interest, and iii) profits and losses for settlement of transactions.

Post-trading customer margin is levied on the open interest at the time of the market close. Therefore, there is no order margin.

- Margin Calculation

-

- Margins for the Securities Market

- Member margins for the securities market are calculated separately for each member and for its self-trading account and brokerage account on the basis of the net buy or net sell position for each item traded on a given day. For self-trading accounts, the total of the variation and net risk margin (100%) is charged, while for brokerage accounts, an adjusted member margin (70%) of 30% less than the total is charged. By providing a reduced customer margin, this methodology is designed to mitigate the burden on members who must deposit all margins with their assets.

- Margins for the Exchange-traded Derivatives Market

- The KRX calculates margins based on the net risk exposure of the total portfolios of futures and options held. It first calculates the margin per product group of underlying assets with similar characteristics – stock indices, stocks, bonds, currencies, commodities, etc. – and sums up the margin of each group to determine the margin requirements. The margin rates applied in the calculation are in principle determined according to the price volatility of the underlying assets and the characteristics of derivatives and market conditions. The KRX distributes the PC-based educational program PC COMS for free on its website to help investors better understand the margin system.