Review Vouchers to Prepare for Hard Close

In preparation for the upcoming hard close, agencies should ensure fiscal year 2023 transactions are fully processed in SWIFT. For Accounts Payable, agencies can run the M_AP_GBL_ EXCEPTION _NO_ACCT_DT query to see a complete list of vouchers with exceptions. After hard close, agencies will not be able to process transactions with Accounting Dates prior to July 1, 2023.

Agencies should also be completing regular voucher maintenance including fixing, closing, or deleting vouchers in recycle status, voucher build errors, budget exceptions, match exceptions, or vouchers that have been denied including journal vouchers. Voucher maintenance is usually more difficult after hard close.

To assist with voucher maintenance, there are several queries agencies can run:

Please see the Accounts Payable Quick Reference Guides for helpful information on deleting and closing vouchers.

Respond to Problem Reports

Encumbrance Certification

Appropriation Problem Reports

SWIFT Hot Topics

SWIFT Hot Topics feature Frequently Asked Questions (FAQs) answered by the SWIFT Training and Help Desk team. Use these as a friendly reminder of a process or as an opportunity to learn something new!

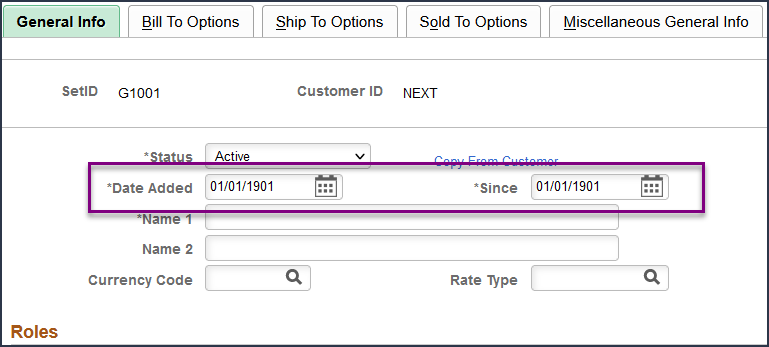

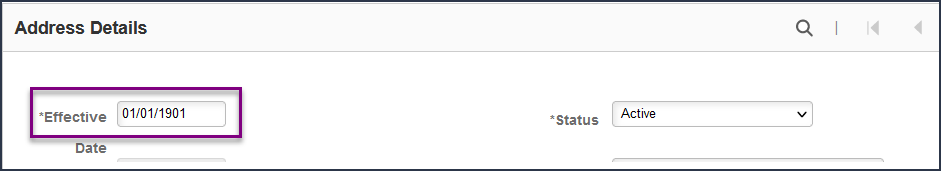

Q. I need to add a customer or a customer contact. What should I use for an Effective date?

A. To provide services and goods to an individual or an organization, you will first need to add a customer in the Billing module of SWIFT. The dates used while adding your customer are very important because they interact with the ability to invoice your customer. You are unable to create a bill with dates previous to the Date Added, Since, or Effective dates entered in your customer record. Therefore, we suggest that you backdate all dates in the customer record to before any possible invoice date.

For more information about adding Customers and their dates, refer to the Enter a New Customer quick reference guide or the Add a Customer video.

Federal Indirect Cost Payments

Agencies need to process their federal receipt vouchers for the indirect costs timely as well to be included in the reverse bilateral netting process. Please see Budget and Accounting Instructions Document 2 for details on how to enter Federal Indirect Cost Vouchers. You can find it on the SWIFT Budget and Accounting Instructions page.

The reverse bilateral netting process will run on August 15, 2023.

Prepare for Major Tax Updates

New taxes included in this notice may have significant impact to SWIFT transactions financially and in terms of the number of transactions affected. If possible, try to get the taxable items delivered no later than September 30, 2023. Taxable items delivered on or before September 30, 2023, benefit from the lower tax rate and these purchase orders do not need to be updated. Sales and use tax rates are based on the agency’s Ship To Location listed on the purchase order.

Notice on New Local Tax

The Minnesota Department of Revenue will be administering the following new sales and use taxes effective October 1, 2023:

The sales and use tax rate changes apply to sales made on or after October 1, 2023. They will be in addition to all other taxes in effect. Local sales tax applies to retail sales made and taxable services provided within the local taxing area (county/city limits). The tax applies to the same items that are taxable under the Minnesota sales and use tax law.

Agencies entering purchase orders for the new fiscal year, prior to the October 1, 2023 tax effective date, will have the old rate calculated and will need to update their purchase orders.

Purchase orders entered in SWIFT on or after October 1, 2023, will calculate the new tax rates for each county/city. Existing purchase orders and/or their vouchers will need to be adjusted to pay the correct tax if delivery occurs after various dates. Please note that the dates will be different based on whether goods or construction materials are being delivered. Check the tax notice for the affected city for the correct dates.

For assistance in changing the sales tax on a purchase order, please consult the Update the Sales Tax Settings on an Existing Purchase Order quick reference guide. You can also view the Update Sales Tax on an Existing Purchase Order video.

Impact of New Local Tax

Please see the Minnesota Department of Revenue tax notice for the appropriate city for guidance in handling purchase orders and payments during the transition period.

Impact on Accounts Payable

Vouchers entered in SWIFT on or after the tax effective date will calculate the new tax rates for each county/city if the Invoice Date is on or after the tax effective date. If the Invoice Date is before the tax effective date, SWIFT will exclude the new tax rates. Please review the tax calculation carefully prior to payment on all vouchers with Ship To locations within these jurisdictions.

Impact on Purchase Orders

SWIFT will be updated with the new tax codes for all existing Ship To addresses located in the affected cities. New purchase orders, created on or after October 1, 2023, will calculate the new rate of tax for the ship to addresses within those counties/cities. Existing purchase orders may or may not need to have the tax code updated on the PO if payment can be processed during any allowed grace period(s), again, see the general notice for each county/city. Previously any Ship To addresses in affected cities may have used the tax code of 0000, State Tax only. To calculate the new combined rate, state and local tax rate, the tax code(s) on the purchase order must be updated to the new tax code(s) from the 0000 tax code. Because of the various transition rules, these codes will not be updated by SWIFT and must be updated by the purchase order buyer.

SWIFT and EPM Data Warehouse Training

The SWIFT Training team offers training through a variety of methods. There are SWIFT training guides and training videos, EPM training guides, webinars, labs, eLearning, and individual sessions (by request through the SWIFT Help Desk).

Find current SWIFT training in Learning Management. Enter "SWIFT" in the Find Learning text entry box.

|

MODULE |

WEBINARS/eLEARNING

|

DATES |

|

INTRO |

Introduction to EPM Data Warehouse/SWIFT |

8/9/23; 10/12/23 |

|

INTRO |

Introduction to SWIFT Navigation webinar |

8/15/23; 9/12/23; 10/17/23 |

|

INTRO |

Overview of SWIFT Reporting webinar |

9/7/23; 10/4/23 |

|

INTRO |

Introduction to SWIFT eLearning |

Anytime |

|

AR |

SWIFT Accounts Receivable Direct Journal Deposits webinar |

8/8/23 |

|

AR |

SWIFT Accounts Receivable Apply Payments to Invoices webinar |

8/9/23 |

|

AR |

SWIFT Accounts Receivable Maintenance Worksheets webinar |

8/10/23 |

|

EPM |

Build a My Dashboard for SWIFT Reports in EPM lab |

9/7/23 |

|

EPM |

Create a SWIFT All Expenditures Report in EPM lab |

10/4/23 |

|

EPM |

SWIFT EPM Create and Save a New Analysis lab |

9/28/23 |

|

EPM |

SWIFT EPM Create and Save the Manager's Financial Report lab |

9/20/2023 |

|

EPM |

Understand the SWIFT Data in the EPM Data Warehouse webinar |

10/4/23 |

|

EPM |

Use SWIFT Standard Reports in EPM lab |

9/13/23 |

|

PO |

SWIFT Create Purchase Orders webinar |

8/8/23 |

|

SC |

SWIFT Create a Supplier Contract Shell webinar

|

8/17/23 |

|

SC |

SWIFT Import and Process Contract Document Electronically webinar

|

8/17/23 |

|

SS |

Strategic Sourcing Part 1: Create, Post, and Approve Events |

8/29/23 |

|

SS |

Strategic Sourcing Part 2: Analyze and Award Events |

8/29/23 |

|

SS |

SWIFT Strategic Sourcing eLearning |

Anytime |

SWIFT Help Desk

Contact the SWIFT Help Desk for any SWIFT-related questions or issues.

Email: [email protected]

Phone: 651-201-8100, option 2

Hours: 7:30 a.m. to 4:00 p.m., Monday through Friday (closed holidays)

When contacting the SWIFT Help Desk, make sure to include details about your question or issue, including:

Additional assistance can be found on the SWIFT Training Guides and Resources page.